COVID-19 Assistance Loans & Grant opportunities

This page serves as a resource on local, state and federal loan or grant programs the Grundy County Chamber and the Channahon Minooka Chamber are aware of. Programs to assist with the impact of COVID-19 are being introduced everyday so please continue to check this page. We also encourage you to talk to your local bank or financial institution about options they have to work with you on during this difficult time.

Restaurant Revitalization Fund

According to the Small Business Administration, The American Rescue Plan Act established the Restaurant Revitalization Fund (RRF) to provide funding to help restaurants and other eligible businesses keep their doors open. This program will provide restaurants with funding equal to their pandemic-related revenue loss up to $10 million per business and no more than $5 million per physical location. Recipients are not required to repay the funding as long as funds are used for eligible uses no later than March 11, 2023.

APPLICATIONS ARE NOT YET OPEN. Preliminary information and preparation documents can be found here.

Eligible entities who have experienced pandemic-related revenue loss include:

- Restaurants

- Food stands, food trucks, food carts

- Caterers

- Bars, saloons, lounges, taverns

- Snack and nonalcoholic beverage bars

- Bakeries (onsite sales to the public comprise at least 33% of gross receipts)

- Brewpubs, tasting rooms, taprooms (onsite sales to the public comprise at least 33% of gross receipts)

- Breweries and/or microbreweries (onsite sales to the public comprise at least 33% of gross receipts)

- Wineries and distilleries (onsite sales to the public comprise at least 33% of gross receipts)

- Inns (onsite sales of food and beverage to the public comprise at least 33% of gross receipts)

- Licensed facilities or premises of a beverage alcohol producer where the public may taste, sample, or purchase products

For more information and to sign up for email alerts visit the Restaurant Revitalization Fund page with the SBA here.

Rural Relief Small Business Grants

As part of our continuing commitment to elevate our impact in rural America, LISC is inviting small business owners in rural locations across the country to apply for the LISC-Lowe's Rural Relief Small Business Grants program.

Fearless Fund

Fearless Fund invests in women of color led businesses seeking pre-seed, seed level or series A financing. Their mission is to bridge the gap in venture capital funding for women of color founders.

Door Dash Local Resturant Grants

Illinois Business Interruption Grant Information and Application

Business Interruption Grants Program (BIG)

The State of Illinois has released its second round of BIG funds. Businesses, organizations and nonprofits can still apply. See link below for the application and details.

State of Illinois loans and grants

Emergency Small Business Grants and Loans Assistance

Under the leadership of Gov. JB Pritzker, the Department of Commerce & Economic Opportunity is working with partners to launch emergency assistance programs for Illinois small businesses. These initiatives include:

Illinois Small Business Emergency Loan Fund

Downstate Small Business Stabilization Programs

Each grant and loan has its own requirements and application process. Please click the above links for the details and to apply. The Chamber is available to answer questions, but is not in charge of applications.

Federal loan opportunities

The Paycheck Protection Program (PPP) provides loans to help businesses keep their workforce employed during the Coronavirus (COVID-19) crisis.

These loans can be forgiven if qualifications are met. President Joe Biden signed the PPP Extension Act of 2021 into law, extending the Paycheck Protection Program an additional two months to May 31, 2021, and then providing an additional 30-day period for the SBA to process applications that are still pending.

Additional changes for small businesses have also been made for the PPP loans. For more information on these changes visit here.

SBA is currently offering:

First Draw PPP Loans for first time program participants have been reopened.

Second Draw PPP Loans began January 13, 2021 for certain businesses who have previously received a PPP loan

For details on First Draw PPP Loans visit: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program/first-draw-ppp-loans

For details on Second Draw PPP Loans visit: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program/second-draw-ppp-loans

Contact your local bank to apply. If you have received funds, also contact your bank for the latest updated information on the forgiveness.

Visit the SBA site for more information on the application and forgiveness requirements.

Grants

Shuttered Venue Operators Grant:

The Shuttered Venue Operators (SVO) Grant program will open Monday, April 26 starting at 11 a.m. Interested applicants need to register at the portal in advance here: application portal. Applicants will also need a smartphone and a multi-factor authenticator app to register and apply.

The program includes $15 billion in grants to shuttered venues, to be administered by the SBA’s Office of Disaster Assistance. Eligible applicants may qualify for SVO Grants equal to 45% of their gross earned revenue, with the maximum amount available for a single grant award of $10 million. $2 billion is reserved for eligible applications with up to 50 full-time employees. For more information and to apply visit: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/shuttered-venue-operators-grant

Barstool Fund: A running crowdfund campaign to raise funds for eligible businesses that apply. For more information and to apply visit:

https://barstool.typeform.com/to/fbCSK7GZ

Made for more small business fund: The makers of Ball® home canning products will award a total of $110,000 to small businesses who have gone above and beyond to give back to their community during the pandemic. Must use Ball products and submissions due by Jan. 31. For more details and to apply visit: https://www.promotionactivator.com/madeformore/

FedEx Small Business Grant Contest: Does not open until Feb. 16, but the grant is giving out $50,000 to get ready. For more information visit: https://www.fedex.com/en-us/small-business/grant-contest.html

Are you a member of the National Association of the Self-Employed? They are offering $4,000 grants for members. For more information visit https://www.nase.org/become-a-member/member-benefits/business-resources/growth-grants

For Women Business Owners/Entrepreneurs: Deadline is Jan. 31 For more information and to apply visit: https://ambergrantsforwomen.com/get-an-amber-grant/

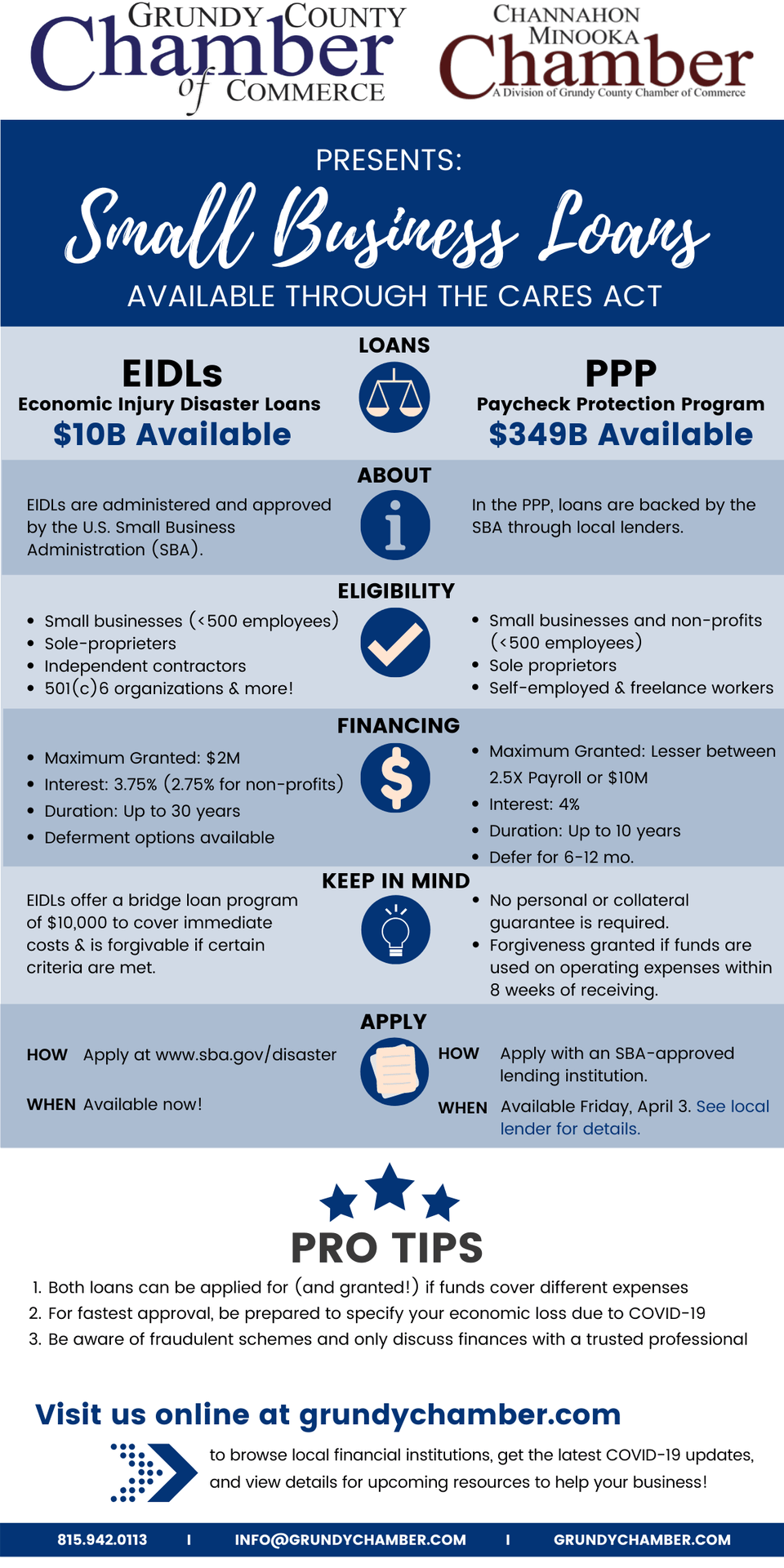

Which Loan Should I Use?

The state and federal governments are offering numerous program and loans to help local businesses impacted by COVID-19. Below is a breakdown of the differences between two of those offerings: the Economic Injury Disaster Loans and the Paycheck Protection Program.

For specific details and to apply visit:

EIDL: https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

PPP: https://home.treasury.gov/cares

PPP FAQ: Download information guide here