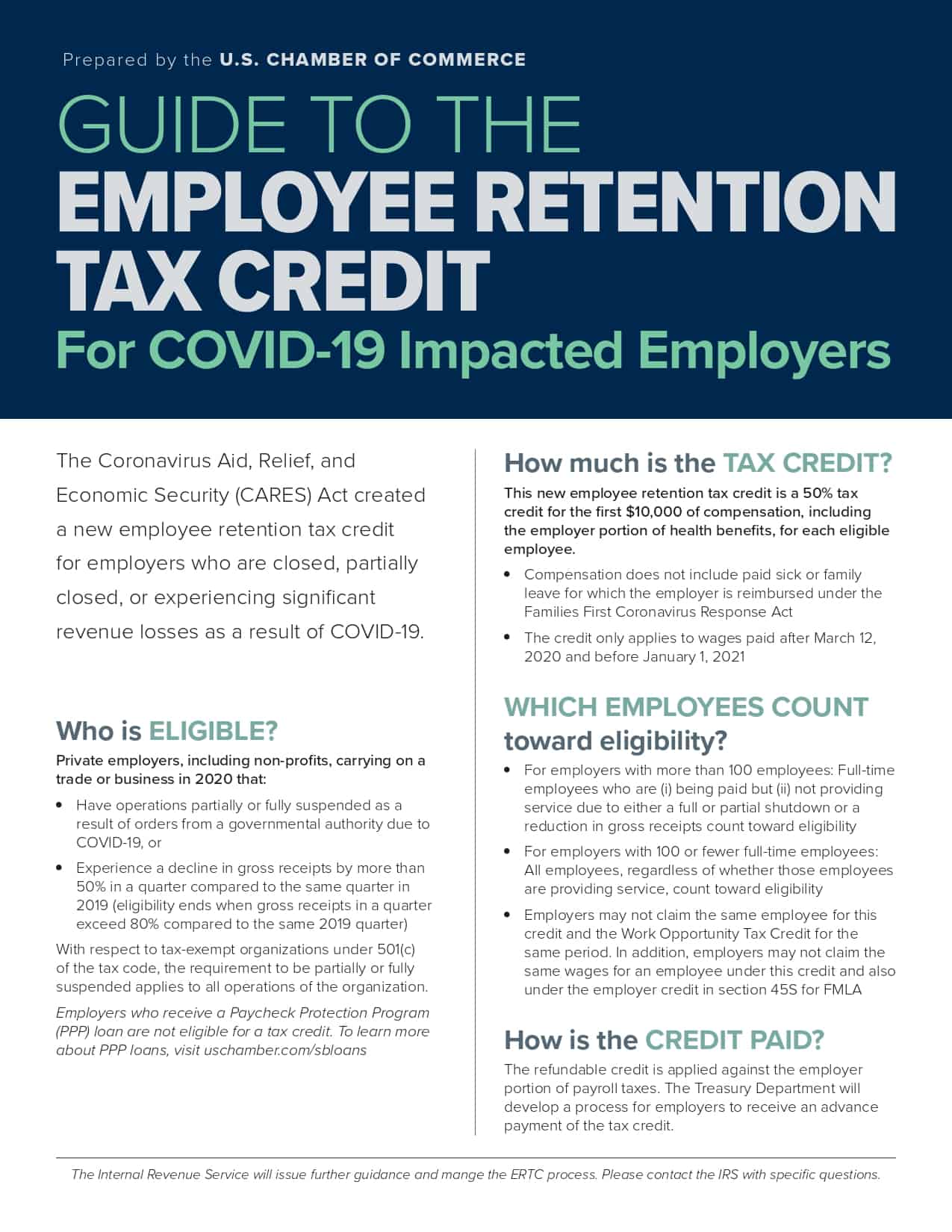

Employee Retention Tax Credit

U.S. Chamber's Guide to the Employee Retention Tax Credit

Who is ELIGIBLE?

Private employers, including non-profits, carrying on a trade or business in 2020 that:

- Have operations partially or fully suspended as a result of orders from a governmental authority due to COVID-19, or

- Experience a decline in gross receipts by more than 50% in a quarter compared to the same quarter in 2019 (eligibility ends when gross receipts in a quarter exceed 80% compared to the same 2019 quarter)

With respect to tax-exempt organizations under 501(c) of the tax code, the requirement to be partially or fully suspended applies to all operations of the organization.

Employers who receive a Paycheck Protection Program (PPP) loan are not eligible for a tax credit. To learn more about PPP loans, visit uschamber.com/sbloans.

How much is the TAX CREDIT?

This new employee retention tax credit is a 50% tax credit for the first $10,000 of compensation, including the employer portion of health benefits, for each eligible employee.

- Compensation does not include paid sick or family leave for which the employer is reimbursed under the Families First Coronavirus Response Act

- The credit only applies to wages paid after March 12, 2020 and before January 1, 2021

WHICH EMPLOYEES COUNT toward eligibility?

- For employers with more than 100 employees: Full-time employees who are (i) being paid but (ii) not providing service due to either a full or partial shutdown or a reduction in gross receipts count toward eligibility

- For employers with 100 or fewer full-time employees: All employees, regardless of whether those employees are providing service, count toward eligibility

- Employers may not claim the same employee for this credit and the Work Opportunity Tax Credit for the same period. In addition, employers may not claim the same wages for an employee under this credit and also under the employer credit in section 45S for FMLA

How is the CREDIT PAID?

The refundable credit is applied against the employer portion of payroll taxes. The Treasury Department will develop a process for employers to receive an advance payment of the tax credit.

The Internal Revenue Service will issue further guidance and mange the ERTC process. Please contact the IRS with specific questions.

CREDIT: U.S. Chamber of Commerce