Federal Coronavirus Emergency Loans Small Business Guide & Checklist

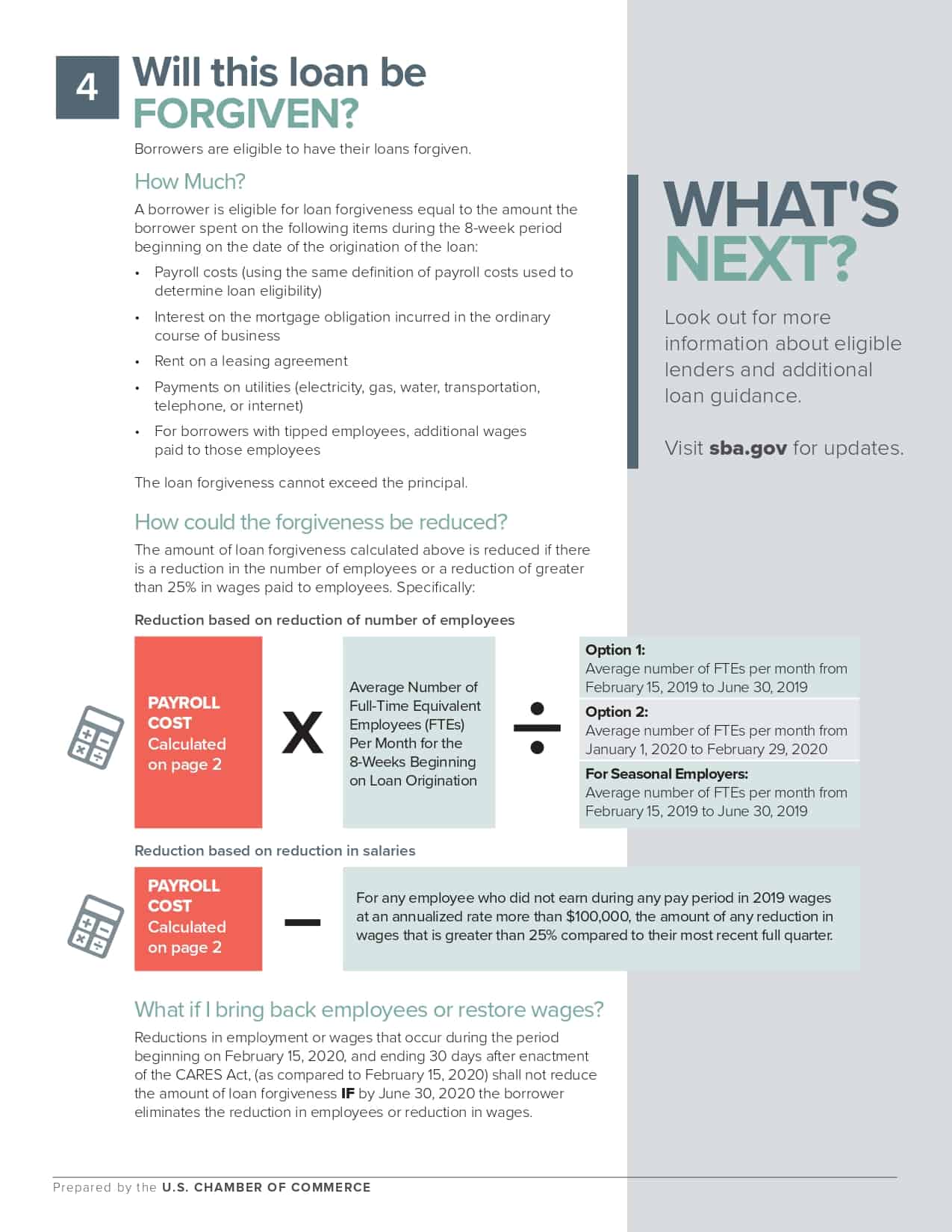

With the President’s signing of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, $350 billion is being allocated to help small businesses. Although in the form of loans, business owners may not have to repay all or any of the loan if they maintain payrolls during the crisis or restore payrolls afterward. Below is information from the U.S. Chamber to help guide our small businesses through the process.

Known as the Paycheck Protection Program, the initiative provides 100% federally guaranteed loans to small businesses who maintain their payroll during this emergency. Importantly, these loans may be forgiven if borrowers maintain their payrolls during the crisis or restore their payrolls afterward.

The loans are through local banks and a list of participating institutions has not yet been released. Please check with your local bank as they may have more information than is released right now. Sba.gov is supposed to provide more information on the list of banks once it is available.

Please read on to learn more...